All Categories

Featured

That's not the very same as investing. They will not only desire you to buy the item, they desire you to go right into service with them, join their group. Ask yourself, has this person that's selling this item to me been doing this for 5 years or at least ten thousand hours' worth of services?

I want you to be an expert, a master of all the knowledge needed to be a success. Do not, Manny, if you do this, don't call a close friend or household for the initial 5 years. And afterwards, by the means, you intend to inquire that in the interview.

Flexible Premium Indexed Adjustable Life Insurance

I mean, that's when I was twenty-something-year-old Brian being in his money class, and I was browsing, going, 'What do these people do after they finish?' And all of them go benefit broker-dealers or insurer, and they're offering insurance coverage. I conformed to public audit, and currently I'm all excited since every parent is typically a CPA that has a kid in this evening.

That's where wisdom, that's where expertise, that's where competence originates from, not just because someone likes you, and now you're gon na go turn them right into a customer. For more info, examine out our cost-free resources.

For as long as I've been handling my own financial resources, I have actually been hearing that individuals ought to "buy term and invest the difference." I have actually never actually taken stock in the concept. I suggest, I am an economic services specialist that reduced her teeth on entire life, but that would adopt this theory focused around getting only term life insurance policy? Approved, term is an affordable sort of life insurance policy, yet it is also a short-term type of insurance coverage (10, 20, thirty years max!).

It makes sure that you live insurance coverage beyond three decades no issue the length of time you live, in truth and relying on the type of insurance policy, your costs amount may never change (unlike eco-friendly term plans). Then there is that entire "invest the difference" thing. It truly rubs me the wrong method.

Keep it real. If for no other reason than the reality that Americans are terrible at conserving cash, "buy term and invest the difference" must be banned from our vocabularies. Hold your horses while I go down some knowledge on this factor: According to the United State Social Protection Management, the average American's annual wage was $42,979.61 in 2011; Yet, just 14.6 percent of American family members had fluid possessions of $50,000 or more throughout that very same period; That indicates that much less than 1 in 4 households would certainly be able to replace one income-earner's wages should they be jobless for a year.

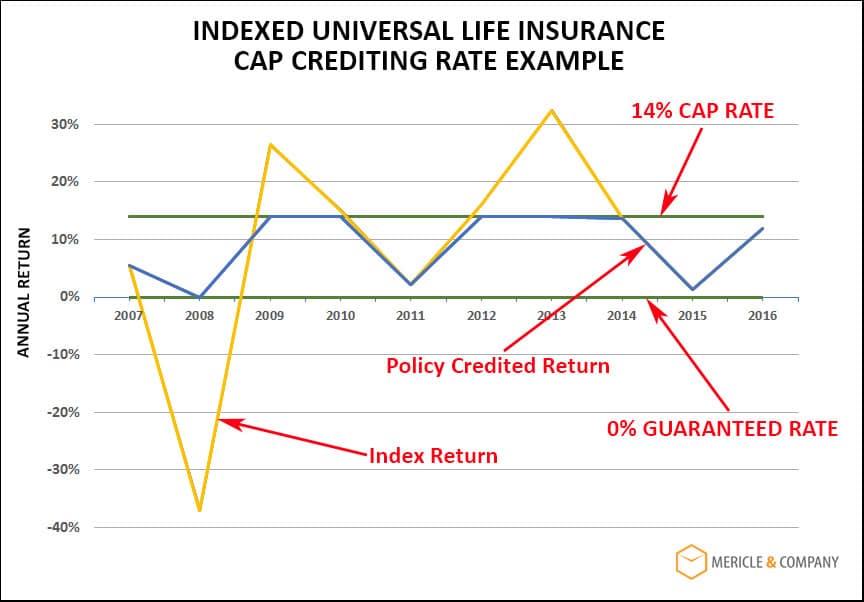

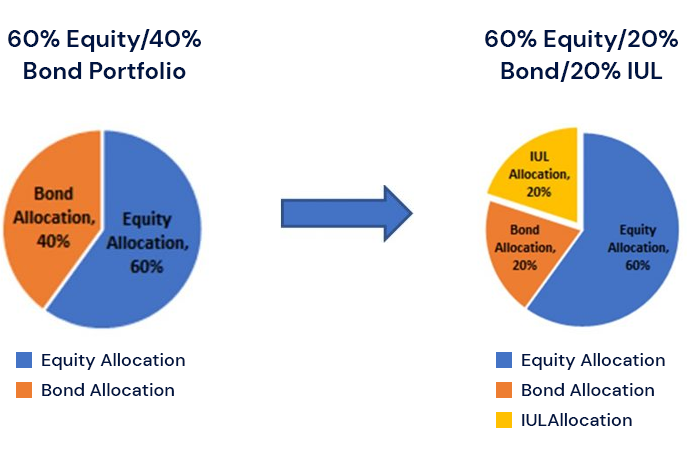

What if I told you that there was a product that could aid Americans to buy term and spend the distinction, all with a solitary purchase? Below is where I get simply downright kooky. Enjoy closelyHave you ever examined just how indexed universal life (IUL) insurance policy technically functions? It is a kind of money worth life insurance coverage that has an adaptable premium repayment system where you can pay as long as you want to develop the cash value of your policy faster (subject to specific limits DEFRA, MEC, TEFRA, etc). indexed whole life insurance.

Latest Posts

Universal Life Guaranteed Rate

Iul Cost

Whole Life Insurance Vs Indexed Universal Life