All Categories

Featured

If you're going to utilize a small-cap index like the Russell 2000, you may desire to pause and take into consideration why a great index fund business, like Lead, does not have any type of funds that follow it. The reason is due to the fact that it's a poor index.

I haven't even resolved the straw male right here yet, which is the truth that it is reasonably rare that you really have to pay either tax obligations or significant payments to rebalance anyhow. I never ever have. Many smart capitalists rebalance as much as feasible in their tax-protected accounts. If that isn't quite sufficient, early accumulators can rebalance purely using new payments.

Universal Life Calculator

And of course, nobody must be purchasing crammed common funds, ever. It's truly too poor that IULs don't work.

Latest Posts

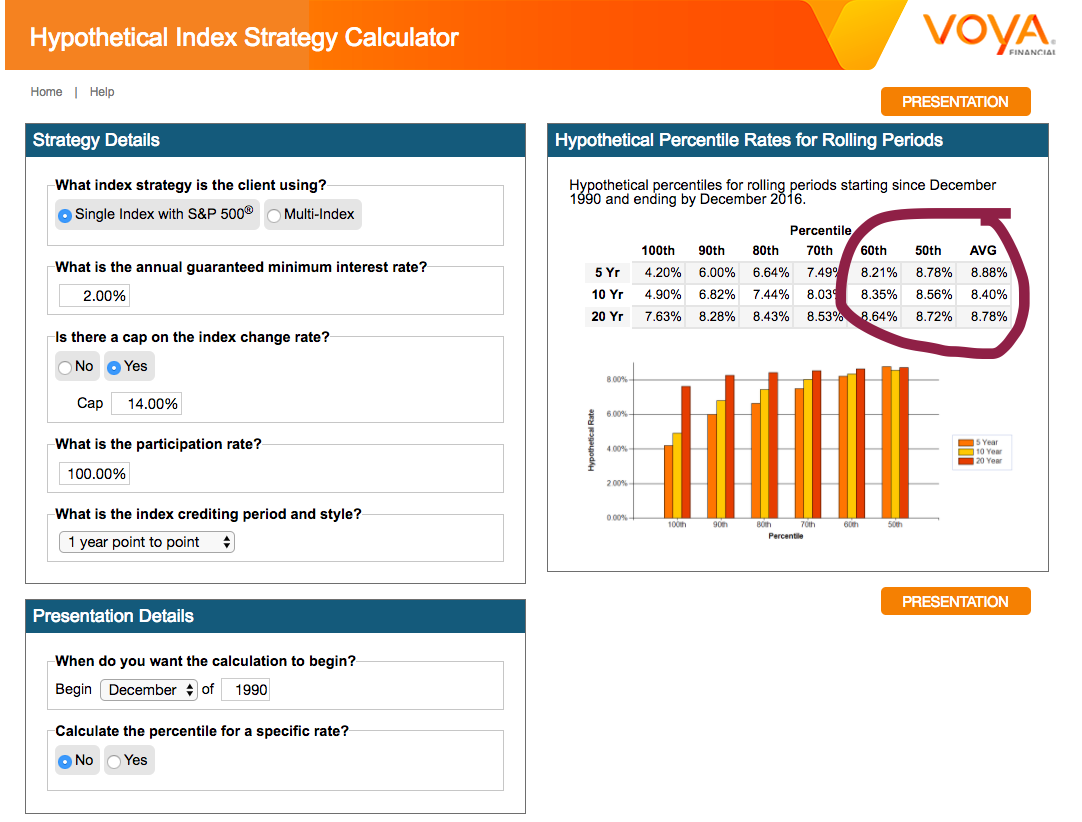

Universal Life Guaranteed Rate

Iul Cost

Whole Life Insurance Vs Indexed Universal Life